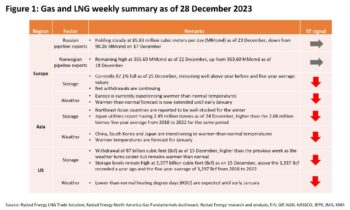

European Title Transfer Facility (TTF) gas prices rose slightly last week on news of transport disruptions in the Red Sea.

This has so far not translated into any significant gain in prices, however, Some price increases this week were instead mainly due to revised weather forecasts which signaled slightly colder temperatures.

The TTF price is at $11.05 per million British thermal units (MMBtu) at the time of writing on 28 December, up from $10.72 per MMBtu on 20 December.

Asian spot prices for liquefied natural gas (LNG) recorded only a marginal reaction to the Red Sea disruptions and were reported at $11.94 per MMBtu for February deliveries on 27 December, up from $11.78 per MMBtu as reported on 19 December.

Warmer weather has been forecast for January, which is likely to continue to keep a lid on prices in the region.

The US Henry Hub price slipped to $2.41 per MMBtu at the time of writing on 28 December from $2.52 per MMBtu on 20 December. Prices rose the week before, despite continued strong domestic gas production, mild weather, and strong storage levels.

The return to a declining trend reflects a return to fundamentals, which is likely to continue unless weather forecasts for the remaining winter turn colder.

Europe

TTF prices rose as high as $12.10 per MMBtu on Wednesday 27 December on the back of colder weather forecasts before coming back down to $11.05 per MMBtu at the time of writing, reflecting the prevailing bearish fundamentals from continued strong supplies and high storage levels.

European underground storage was at 100.10 billion cubic meters (Bcm) or 87.1% as of 25 December, which is higher than the 93.81 Bcm or 83% on the same date last year.

This is also close to the five-year maximum of 101.76 Bcm from 2018 to 2022.

Norwegian gas pipeline flows remained strong at 355.60 MMcmd on 22 December, little changed from a week before. Russian gas pipeline supply was 85.83 million cubic meters per day (MMcmd) as of 23 December, slightly lower than the 90.26 MMcmd reported on 17 December.

Weather forecasts for Europe were revised to be slightly colder, with lower-than-normal temperatures expected after the first week of January.

The winter has on average been warmer than normal so far, with existing gas pipeline and underground storage supplies at high levels, even compared to last year.

As a result, the slight downward change in temperature forecasts on 27 December only brought a short-lived increase in TTF prices, which closed lower by the end of the day.

Asia

The Asia LNG spot price for February was around $11.87 per MMBtu as of 27 December, little changed from $11.75 per MMBtu on 19 December.

Tracking the TTF prices, there was also an increase in the Asia LNG spot price in the latter half of last week due to news of transport disruptions in the Red Sea, however the increase has been marginal.

East Asian utilities are well-stocked, despite a spate of cold weather in the region during December.

This has resulted in relatively weak demand during most of December and is likely to also bring weaker January demand as warmer weather is expected throughout East Asia from January onwards. China, South Korea, and Japan have all transitioned out of a phase of cold temperatures to warmer-than-normal temperatures.

In China, the weather has already turned warmer than normal. Beijing, which had temperatures that were 11°C below seasonal norms a week ago, is now expecting temperatures of 7°C above seasonal norms by the turn of the year.

Cold winds are expected to increase in frequency, which may bring temperatures back to normal, but given the low intensity of the winds, warmer-than-normal temperatures are still expected for the next two weeks.

In South Korea, temperatures have risen to warmer than normal and are expected to remain so until 8 January.

According to the Korean Meteorological Administration (KMA), temperatures are then expected to fall from 8 January to 14 January with a 40% probability of below-normal temperatures, and a 40% probability of normal temperatures.

From 15 January to 28 January, there is a 40% probability of above-normal temperatures and a 40% probability on normal temperatures, indicating a temperature increase that would curb LNG demand.

The Japan Meteorological Agency (JMA) is expecting warm temperatures throughout Japan until 12 January, with a minimum 60% probability of warmer-than-normal temperatures across all prefectures other than Hokkaido.

A warmer-than-normal winter is expected until March, with a minimum 50% probability of higher-than-normal temperatures expected across the entire country.

Japan utility LNG inventories were reported to be 2.49 million tonnes (Mt) as of 24 December. This is slightly less than the 2.53 Mt recorded at year-end 2022, but is higher than the five-year average of 2.06 Mt for end-December from 2018 to 2022.

Most of East Asia transitioning to warmer-than-normal temperatures amid higher storage levels is likely to keep demand suppressed.

US

The Henry Hub price slipped to $2.41 per MMBtu on 28 December from $2.52 per MMBtu on 20 December.

Higher prices in the previous week may have been due to uncertainty in forecasts.

The return to a declining price trend more accurately reflects the bearish fundamentals in what has been a warmer-than-normal winter so far.

US underground storage was at 3,577 billion cubic feet (Bcf) or about 85.25% full as of 15 December. This is higher than the 3,337 Bcf at the same time last year, and also higher than the five-year average of 3,297 Bcf during the same period from 2018 to 2022.

Withdrawals from storage were at 87 Bcf last week, up from the 55 Bcf withdrawals reported the week before.

Withdrawals have so far been low due to a warm start to the winter.

The number of heating degree days (HDDs), which reflect the extent of heating required, has been below normal so far, with a deviation of 28 fewer HDDs from the normal reported on 15 December.

Weather forecasts are expecting the number of HDDs to increase until 5 January but remain slightly below normal.

Gas demand for heating is likely to rise as a result but will still remain below seasonal norms.

A combination of warmer weather, high underground storage levels, and high domestic gas production is expected to keep US prices suppressed.

By Rystad Energy’s gas and LNG market update from senior analyst, Lu Ming Pang