*Deal to make GIP one of the world’s biggest infrastructure investors

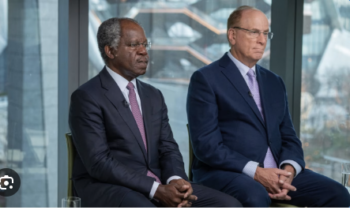

*Company appoints Ogunlesi to board

American multinational, BlackRock Inc. has acquired Global Infrastructure Partners (GIP), a leading independent infrastructure fund manager owned by Nigeria’s Adebayo Ogunlesi, for about $12.5 billion.

The transaction has created a world leading infrastructure private market investment platform.

According to a joint statement issued yesterday, BlackRock will pay $3 billion in cash and about 12 million shares, worth about $9.5 billion at Thursday’s close, and the deal is expected to close in the third quarter of 2024.

The deal has launched BlackRock, the world’s biggest money manager, into the top ranks of investors that make long-term bets on energy, transportation and digital infrastructure. GIP manages $100 billion.

The deal is also expected to make GIP one of the world’s biggest infrastructure investors.

However, subject to completion of customary onboarding procedures, BlackRock has agreed to appoint Ogunlesi, who is currently the Founding Chairman and Chief Executive Officer of GIP into its board at the next regularly scheduled board meeting following the closing of the transaction.

Also, Ogunlesi, a former Credit Suisse executive and one of the founding partners at GIP’s management team, has also been appointed to lead the combined, highly complementary infrastructure platform.

The GIP is the world’s largest independent infrastructure manager with over $100 billion in AUM and a strong reputation for driving operational improvements in its portfolio companies and proprietary origination.

The transaction, the statement explained, created a market-leading, multi-asset class infrastructure investing platform with combined client AUM of over $150 billion across equity, debt and solutions and strengthened deal flow and co-investment opportunities.

The statement added that the transaction was structured for leadership continuity and alignment with BlackRock’s stockholders, with a substantial majority of total consideration to be paid in BlackRock stock.

A $1 trillion market today, infrastructure had been forecast to be one of the fastest growing segments of private markets in the years ahead. A number of long-term structural trends support an acceleration in infrastructure investment.

These include increasing global demand for upgraded digital infrastructure like fiber broadband, cell towers and data centers; renewed investment in logistical hubs such as airports, railroads and shipping ports as supply chains are rewired; and a movement toward decarbonisation and energy security in many parts of the world.

Further, large government deficits mean that the mobilisation of capital through public-private partnerships will be critical for funding important infrastructure.

Finally, as capital has become more scarce in a higher interest rate environment, companies are exploring partnership opportunities for their embedded infrastructure assets to improve their returns on invested capital or to raise capital to reinvest in their core businesses.

BlackRock has a broad network of global corporate relationships as a long-term investor in both their debt and equity. These relationships will help them lead critical investments in infrastructure to improve outcomes for communities around the globe and generate long-term investment benefits for clients.

The combination of GIP with BlackRock’s highly complementary infrastructure offerings create a comprehensive global infrastructure franchise with differentiated origination and asset management capabilities.

The over $150 billion combined business would seek to deliver clients market-leading, holistic infrastructure expertise across equity, debt and solutions at substantial scale.

The joint statement stated that marrying the proprietary origination and business improvement capabilities of GIP and BlackRock’s global corporate and sovereign relationships provides a platform for diversified, large-scale sourcing to support deal flow and co-investment opportunities for clients.

“We believe bringing GIP and BlackRock together will deliver to clients the benefits of broader origination and business improvement capabilities,” the statement said.

Founded in 2006, world leading independent infrastructure investor, GIP, manages over $100 billion in client assets across infrastructure equity and debt, with a focus on energy, transport, water and waste, and digital sectors. GIP’s performance has been driven by proprietary origination, operational improvements, and timely exits. They have successfully scaled their global equity flagship series, with the most recent fully invested flagship fund in 2019 surpassing $22 billion.

BlackRock’s over $50 billion of infrastructure client AUM comprises infrastructure equity, debt and solutions, and has grown both organically and inorganically since inception in 2011. Top investment talent at BlackRock lead franchises that include Diversified Infrastructure, Infra Debt, Infra Solutions, Climate Infrastructure and Decarbonisation Partners.

According to BlackRock, the GIP team would bring with them talented investment, and operationally focused business improvement teams with a strong track-record of building and running high-performing private markets businesses.

“GIP’s founders and teams remain highly committed to clients, and we expect the integration with BlackRock’s broader platform will generate even greater opportunities.

“Infrastructure is one of the most exciting long-term investment opportunities, as a number of structural shifts re-shape the global economy. We believe the expansion of both physical and digital infrastructure will continue to accelerate, as governments prioritise self-sufficiency and security through increased domestic industrial capacity, energy independence, and onshoring or near-shoring of critical sectors.

“Policymakers are only just beginning to implement once-in-a-generation financial incentives for new infrastructure technologies and projects,” Chairman and Chief Executive Officer of BlackRock, Laurence D. Fink, stated.

He added, “I’m delighted for the opportunity to welcome Bayo and the GIP team to BlackRock, and happy to announce our plans to have Bayo join our Board of Directors post-closing. We founded BlackRock 35 years ago based on a unique understanding of investment risk and the factors and forces driving investment returns.

“GIP’s deep understanding of the factors and forces driving operational efficiency for long-term value creation have made them a global leader in infrastructure investing. Bringing these two firms together will create the infrastructure platform to deliver best-in-class investment opportunities for clients globally, and we couldn’t be more excited about the opportunities ahead of us.”

Also, GIP’s Founding Partner, Chairman and Chief Executive Officer, Ogunlesi, said, “I’m excited about the power of this combination and the prospect of working with Larry and his talented team. We share with BlackRock a culture of collaboration, client focus, investment partnership, and commitment to excellence. Investors have adopted private infrastructure investing for its ability to provide stable cash flows, less correlated returns, and a hedge against inflation.

“Global corporates have turned to private infrastructure as a fast innovator and a more commercially agile owner of infrastructure assets that aren’t core to their commercial businesses. This platform is set to be the preeminent, one-stop infrastructure solutions provider for global corporates and the public sector, mobilising long-term private capital through long-standing firm relationships,

“We are convinced that together we can create the world’s premier infrastructure investment firm.”

GIP is the largest independent infrastructure manager by assets under management globally, with over $100 billion in AUM across infrastructure equity and credit strategies supported by approximately 400 employees.

Its over 40 portfolio companies generate over $75 billion in annual revenue and employ approximately 115,000 people around the world. GIP’s success has been driven by its targeted focus on real infrastructure assets in the transport, energy, digital, and water and waste sectors.

GIP’s in-depth knowledge of target industries underpins its ability to originate proprietary transactions through outright ownership and corporate joint ventures, conduct deep and extensive diligence, and structure investments.

In addition to proprietary origination, business improvement is a key pillar of GIP’s infrastructure approach, with a dedicated team delivering deep operational enhancements. GIP has executed successful exits across multiple channels. Among GIP’s investments are Gatwick, Edinburgh, and Sydney Airports, CyrusOne (data centers), Suez (water and waste), Pacific National and Italo (rail), Peel Ports and Port of Melbourne, and several major renewables platforms, including Clearway, Vena, Atlas and Eolian.

Under the terms of the transaction, BlackRock would acquire 100 per cent of the business and assets of GIP for total consideration of $3 billion in cash and approximately 12 million shares of BlackRock common stock.

Approximately 30 per cent of the total consideration, all in stock, will be deferred and is expected to be issued in approximately five years, subject to the satisfaction of certain post-closing events.

BlackRock intends to fund the cash consideration through $3 billion of additional debt. BlackRock is currently rated AA- with S&P and Aa3 with Moody’s, and this transaction is not expected to meaningfully change its leverage profile. A securities rating is not a recommendation to buy, sell or hold securities and may be subject to revision or withdrawal at any time.

The deal is expected to be modestly accretive to BlackRock’s as-adjusted earnings per share and operating margin in the first full year post-close.

The transaction was expected to close in the third quarter of 2024 subject to customary regulatory approvals and other closing conditions.

Source: ThisDay Newspaper