…CNG and Mini LNG Top in the Agenda

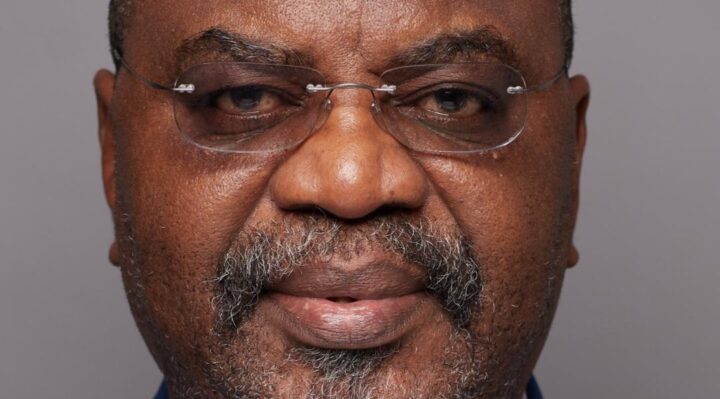

Nathaniel Oyatogun is the Managing Director of Aspen Energy. A former staff member of Shell Petroleum Development Company, he has over three decades of experience in hydrocarbon exploration and production, both in Nigeria and across other parts of the world. In this interview with Olusola Bello of Business Standards, he outlines Aspen Energy’s activities across the hydrocarbon value chain, the company’s future plans, and offers advice on what the government should do to ensure improved and stable electricity supply.

Aspen Energy is an integrated company that provides specialised services to the oil, gas, and power industries in Nigeria. Its services cover the entire value chain—upstream, midstream, and downstream. The company is involved in exploration and production, subsurface and geological studies, and petroleum engineering. It supports organisations in firming up field development plans and is also engaged in asset management, engineering services, and manpower provision for the oil and gas industry. Over its 15 years of existence, Aspen Energy has executed these functions excellently.

A significant number of its technical staff—professionals in their respective fields—are seconded to organisations within the oil and gas sector. Through this, Aspen Energy supports operations in areas such as information technology for production operations, maintenance, geology, and geophysics. Many of these organisations lack adequate in-house capacity to successfully execute their operations.

Aspen Energy also assists organisations with high-level negotiations to enable them secure the necessary agreements required for executing contracts in the gas and power industries. These legal agreements include Gas Supply Agreements (GSAs), Gas Sales and Purchase Agreements (GSPAs), Gas Transportation Agreements, Network Code compliance, and others.

In summary, the company’s operations span the entire hydrocarbon value chain. Aspen Energy also supports Power Purchase Agreements (PPAs) and has previously managed power plant and distribution services.

The Managing Director, Nathaniel Oyatogun, an ex-staff of Shell Nigeria Gas, possesses extensive and practical knowledge of the oil and gas industry. He has participated in major projects including the West African Gas Pipeline and Nigeria Liquefied Natural Gas (NLNG), among others.

The company’s core strength lies in gas and power, as well as subsurface petroleum engineering. Its niche is helping organisations grow. Aspen Energy has supported several major oil and gas companies in developing gas and condensate strategies, many of which are now performing excellently. The company also participated in the development of the Nigerian Gas Master Plan from inception and subsequently developed Gas Master Plans for Ondo, Oyo, and Rivers States. Within just 15 years, Aspen Energy has recorded significant achievements.

Expansion Plans

According to Oyatogun, Aspen Energy plans to expand its footprint into other segments of the oil and gas value chain this year.

The company is currently working towards establishing its own midstream processing facilities, with a focus on Compressed Natural Gas (CNG) and Mini LNG projects.

“We are keeping our minds open to upcoming bid rounds and will take interest where opportunities exist. We are well positioned to manage and execute world-class projects.”

Views on the Petroleum Industry Act (PIA)

The industry has identified areas requiring amendments in the Petroleum Industry Act (PIA). Although the PIA came nearly 20 years late, it is better than nothing. During those two decades of delay, the global energy landscape evolved significantly.

For instance, Nigeria is only now developing NLNG Train 7. When the Nigeria Gas Association (NGA) was formed, the expectation was that by 2025 Nigeria would have more than 12 LNG trains. The delay has caused Nigeria to miss significant opportunities.

Gas projects require established markets before field development begins. If fiscal terms are unattractive, investors—particularly foreign investors—will be unwilling to commit capital.

Although the PIA has been passed, it requires amendments to align it with current realities. Nigeria’s proven gas reserves stand at about 210 trillion cubic feet (TCF), ranking the country 9th or 10th globally. However, Nigeria’s gas potential is closer to 600 TCF. Dedicated gas exploration could significantly unlock GDP growth.

Nigeria needs more midstream infrastructure—fertiliser, methanol, and petrochemical plants—which drive employment and industrial growth. Had Nigeria developed the Gas Revolution Industrial Park earlier, it could have benefited from increased global fertiliser demand during the Russia–Ukraine war.

Nigeria also needs more bankable gas projects and additional LNG trains to take advantage of global supply gaps, particularly in Europe, which is seeking alternatives to Russian gas. Liberalising the gas market and transitioning to willing-buyer, willing-seller arrangements are critical components of optimising the PIA.

Is There Hope for Nigeria?

“Yes, there is hope,” Oyatogun said.

Security improvements in the Niger Delta and efforts to curb oil theft are commendable. Pipeline vandalism must end to attract more investment into the gas sector.

Increased investment will expand midstream capacity, which holds immense potential to drive GDP growth. This would enable increased power generation and growth in petrochemicals, fertilisers, urea, methanol, and other gas derivatives. Even as Nigeria exports LNG, domestic LNG supply remains essential.

Incentives

The government has made efforts to incentivise industry development, but more needs to be done. Executive Orders addressing offshore gas development and clarifying the roles of the Nigerian Upstream Petroleum Regulatory Commission (NUPRC) and the Nigerian Midstream and Downstream Petroleum Regulatory Authority (NMDPRA) are positive steps.

Recent investment decisions, such as Shell’s HI gas development project, demonstrate progress. However, many offshore gas fields remain undeveloped. What is needed are the right incentives and a stable investment climate that ensures profitability.

Nigeria has opportunities to expand its LNG footprint, extend the West African Gas Pipeline beyond Ghana, and advance the Nigeria–Morocco Gas Pipeline. The country must also explore alternative ways of monetising its abundant natural resources.

Aspen Energy’s Five-Year Projection

Aspen Energy fully supports the Federal Government’s Decade of Gas Initiative (2021–2030), aimed at increasing gas production, domestic utilisation, and gas trading hubs.

Nigeria currently generates about 5 gigawatts of electricity—grossly inadequate for a population of over 200 million. Power generation should increasingly be decentralised, producing electricity close to consumption centres. Lagos State’s initiative to boost power generation is commendable and best supported through gas-fired thermal plants.

However, agreements must be bankable. The government must resolve outstanding debts in the power sector. Over ₦4 trillion is owed to gas suppliers—funds that could have been invested in drilling new wells and expanding reserves.

Gas production requires continuous investment as reservoir pressure declines over time. With Nigeria’s population projected to reach 250 million in the coming years and potentially rank among the top four globally by 2050, energy demand will grow significantly.

The government should settle outstanding obligations or fully liberalise the sector to allow private-sector efficiency and competition—similar to what transformed the telecommunications industry.

Nigeria’s power sector also suffers from ageing infrastructure and poor metering. Achieving 100% smart metering is essential to reduce losses, improve collections, and discourage energy theft.

Many consumers who can afford it are switching to solar energy due to unreliable grid power. Even the transmission capacity of 7,500 megawatts is insufficient. A fundamental shift in approach is required.

Licensing and Bid Rounds

Nigeria must increase rig counts, daily production, and reserves to boost revenue, stabilise the naira, and support domestic needs before focusing on exports. This would reduce pressure on foreign exchange and the Central Bank of Nigeria.

As bid rounds open, the NUPRC must ensure transparency and efficiency to attract investors. Aspen Energy stands ready to support bidders with technical expertise, project development, and acquisition support, leveraging its in-house capacity and extensive industry experience.